As Congress contemplates repeal or reform of the Affordable Care Act, forecasters are busy projecting how the proposed changes to the law will affect health insurance coverage, access to care, and spending. Accurate forecasting models allow competing policy proposals to be compared on a level playing field.

Recently, HCP faculty members Laura Hatfield, Michael Chernew, and Tom McGuire, with their collaborator Melissa Favreault at the Urban Institute, built a model that forecasts health insurance coverage and health care spending of older adults in the U.S. The researchers used the model to predict that near-poor older adults, who lack either the protections of Medicaid or the resources of higher-income individuals, will face out-of-pocket spending growth that renders them effectively underinsured, despite Medicare coverage.

Their dynamic microsimulation model, based on the Urban Institute’s DYNASIM model extended to health care, allows the team to make detailed predictions that reflect both underlying health care spending growth pressures and behavioral responses of individuals.

They begin with a simulated population that mirrors the U.S. population of adults aged 65 and older. Each person in the simulated population has characteristics such as age, income, and disability such that the simulated population has the same distribution of age, income, disability, etc. as the actual 65-and-older population.

The simulation then updates the characteristics of each individual over time using a large collection of models that reproduce patterns found in real data. For example, simulated individuals enter long-term nursing homes according to a model that depends on age, disability, Medicaid eligibility, household composition, and more. By starting the simulation in a historical year, the researchers verify that the simulated population evolves like to the real population.

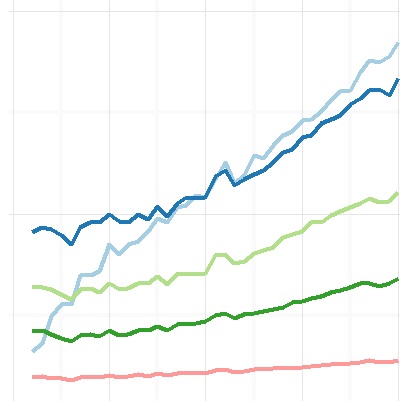

Then they run the simulation into future years. This creates a rich picture of the health status, health insurance coverage, and health care spending of the population. The researchers can dive deeply into the simulated data and answer detailed, policy-relevant results.

In a recent paper published in the journal Health Services Research and covered in Forbes, Hatfield and colleagues asked, “By 2035, what fraction of seniors with incomes in the second-lowest segment of the income distribution will have persistently high health care spending?” Using their microsimulation model, the researchers project that more than three-quarters of these near-poor seniors will spend at least 20% of their per-capita income on health care for at least five consecutive years.

Although Medicare provides basic coverage, beneficiaries still bear a substantial share of their medical expenses because Medicare coverage is incomplete. As Hatfield explained, “We project that half of lower-income seniors will spend at least 25% or their income on health care in 2035.”

This research suggests that such high out-of-pocket spending is unlikely to dampen demand enough to have substantial impacts on overall spending growth. “Reforms that rely on consumers to bear more out-of-pocket expenses and thus spend less on less health care seem unlikely to succeed if these patterns hold more broadly,” Hatfield said.